Frasers Group and Next have been back to their acquisitive best.

Over the past week, Next has swooped to buy FatFace whilst Mike Ashley’s group have snapped up German sporting chain SportScheck and has lifted its stakes in Asos to 22.8%, sparking takeover speculation, and in Boohoo to 15.1%, becoming its largest shareholder.

As the pair continue to build their empires, Retail Gazette looks at what businesses the two groups own and their timeline of acquisitions.

What does Frasers Group own?

Acquisitions

SportScheck

Acquired: October 2023

Frasers Group revealed this week it was set to add leading German sports retailer SportScheck to its rapidly increasing portfolio.

Murray said the purchase would support the group’s growth in Europe and was a “big step” towards its “journey to becoming the number one sports retailer in EMEA”.

Frasers confirmed that the retailer would equally from the its Elevation Strategy which has driven strong performance across the business by investing in store concepts, digital capabilities and strengthened brand relationships.

Former-JD Sports fashion brands

Acquired: February 2023

At the start of the year JD Sports formally completed the divestment of non-core UK fashion brands to Frasers Group.

Brands including Tessuti, Scotts, Choice, Giulio and Cricket brands were all sold to Mike Ashley’s Frasers under the terms outlined on 16 December 2022.

Rascal Clothing was withdrawn from the deal due to one of the founders exercising a pre-emption right, which was agreed upon as part of JD’s acquisition in February 2019 but the sporting group said it expects the divestment of Topgrade Sportswear to also be completed in due course.

Amara.com

Acquired: December 2022

Late last year, Frasers Group added online homewares retailer Amara.com to its vast retail portfolio for an undisclosed sum.

The online platform houses over 300 of the world’s leading home brands such as Missoni, Versace Home and more.

Frasers Group chief executive Michael Murray said: “This acquisition will build on our ambitions to create a credible homeware destination for Flannels.”

Gieves & Hawkes

Acquired: November 2022

In November last year, the retail conglomerate snapped up the Gieves & Hawkes brand and five UK stores, including its Savile Row shop.

Murray, at the time of the acquisition, said: “This acquisition further adds to our portfolio of strategic investments in luxury and premium brands.”

The 250-year-old menswear retailer was put up for sale after its owner, Hong Kong-based Trinity Group, went into liquidation in December 2021.

ISawItFirst.com

Acquired: July 2022

ISawItFirst.com was acquired by Frasers Group last July, the latest in the tranche of online retailers it has snapped up this year.

It emerged this week that Frasers only paid £1 for the retailer, which was set up by Jalal Kamani, the brother of Boohoo co-founder Mahmud Kamani.

Frasers Group stated that at the time of the acquisition, that the online fast fashion retailer owed £13m to its shareholders.

The retail group must have been impressed with ISawItFirst’s CEO Greg Pateras, who it hired to oversee both the brand and its earlier acquisition Missguided, not long after it acquired the brand.

Missguided

Acquired: June 2022

Missguided was acquired by the group in a £20m deal last June following its administration.

The brand collapsed after its clothing suppliers that were owed millions issued a winding up petition.

This was not the first time it experienced troubles. In the latter half of 2021, Missguided sold 50% of the business to Alteri Investors as it sought emergency funding.

Young fashion retailers Missguided and ISawItFirst now operate under one division.

Studio Retail

Acquired: February 2022

Frasers Group picked up Studio Retail out of administration in a £26.8m deal.

The Mike Ashley-controlled retail group had been the catalogue and online retailer’s biggest shareholder, holding a 28.9% stake at the point of its collapse.

Studio plunged into administration after its request for a short-term loan from its bank was rejected. The brand needed the loan while it sold through excess stock it was left with after shipping issues peak last year caused delivery delays.

Jack Wills

Acquired: August 2019

Frasers Group, then Sports Direct, snapped up the Jack Wills brand and UK trading assets in a £12.8m pre-pack administration deal in August 2019.

The retailer, popular for its preppy style, brought in administrators after it struggled with cash flow after it plunged to a pre-tax loss of £29.3m in the year to 31 January, 2018.

Since then, the brand has been stocked in House of Fraser while several underperforming Jack Wills stores have closed down.

The brand continues to operate as a separately under the Frasers umbrella.

Sofa.com

Acquired: February 2019

Frasers Group acquired Sofa.com in February 2019 for a “nominal sum” beating out furniture specialist ScS Group.

The furniture brand, which had concessions in House of Fraser, reportedly suffered after the department store fell into administration in 2018.

After being bought out, it continues to operate as a separate brand and has retained its concessions in House of Fraser.

House of Fraser

Acquired: August 2018

As one of the group’s most high profile acquisitions, House of Fraser was snapped up in a £90m pre-pack administration deal in 2018.

At the time, its then-CEO Mike Ashley made promises to turn the 173-year-old retailer into the ‘Harrods of the high street’.

However, the retailer has been in terminal decline since entering administration – with Ashley even branding the acquisition as a mistake in 2019.

Its stores have been gradually disappearing from the high street with just over 20 left across the UK. It had 59 when the group bought it.

Murray revealed earlier this month that the House of Fraser branding was set to disappear on the high street as the Group rebrands the remaining 20-plus stores into its premium concept, Frasers

Evans Cycles

Acquired:October 2018

Sports Direct snapped up Evans Cycles in a pre-pack administration deal, which saw half of the bike retailer’s stores close.

Little is known about how the brand has performed since the acquisition, although it is likely the retailer had a bumper time during the pandemic when cycling took off.

Game

Acquired: June 2019

Mike Ashley added Game to his retail empire in June 2019 in a £52m deal.

Frasers Group, which was Sports Direct at the time, had built a sizeable share in the gaming retailer, which it upped to 30% in 2019, sparking a mandatory takeover bid.

Since the acquisition, Game has strengthened its position. The retailer, which had been in a perilous position as gamers were increasingly bypassing traditional retailers, has been creating gaming spaces both in stores and online.

Agent Provocateur

Acquired: March 2017

Frasers Group acquired Agent Provocateur in a pre-pack administration deal worth £27.5m back in March 2017.

The lingerie retailer was put up for sale by its private equity owner, 3i, after it struggled from challenging trading conditions and an accountancy error in November that lowered the value of the business by £39m.

It continues to operate as a separate brand with its own stores as well as stocked in some of Ashley’s stores and other retailers.

Flannels

Acquired: 51% stake in 2012, full control in September 2017

The retail conglomerate announced in September 2017 it had taken full ownership of Flannels having previously acquired a 51% stake back in 2012.

The multi-brand retailer stocks a long list of designer brands including Gucci, Vivienne Westwood and Stone Island.

Since then, the group has been persistent on its expansion plans for the retailer opening new flagship stores in major UK cities and entering the Irish market.

USC

Acquired: 80% stake in 2011, fully owned 2015

Frasers Group, then Sports Direct, bought an 80% stake in USC from Scottish entrepreneur Sir Tom Hunter for £7m in July 2011.

However, in early 2015 the young fashion retailer plunged into administration and was bought back by Frasers-owned Republic.

The USC brand name was retained, and Republic was retired.

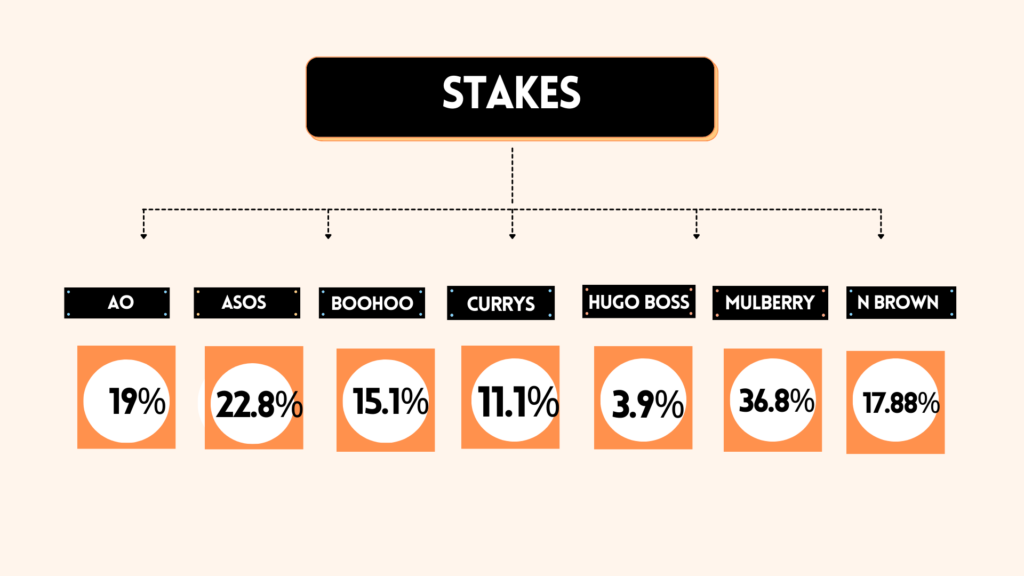

AO

This week Frasers took a 19% stake in Bolton-based online electrical retailer AO World, worth £75 million.

Michael Murray said that “through this investment, Frasers will benefit from AO’s valuable know-how in electricals and two-man delivery, helping us to drive growth in our bulk equipment and homeware ranges. In turn, AO will have the opportunity to benefit from Frasers’ expertise and ecosystem.”

Asos

Frasers increased its stake in Asos once again this week to 22.8%, up from 19.7%, as speculation over a possible takeover of the embattled online fashion retailer mounts.

The group, which is one of the fashion retailer’s biggest shareholders, has taken advantage of Asos’ sensitive market price as the business continues to its turnaround programme.

Boohoo

Frasers became the largest shareholder in Boohoo earlier this month after it upped its stake to 15.1%.

It first snapped up a 5% holding in June as part of a “strategic investment” into the retailer.

The group said: “We see potential synergies and an opportunity to strengthen our own brand proposition in collaboration with Boohoo, most obviously with Frasers Group brands I Saw It First and Missguided.”

Currys

Frasers upped its stake in the electricals retailer to 11.1% in July as the pair began discussions about a possible tie-up.

The retail giant said its investment in Currys “provides us with a valuable opportunity to build on our foothold in the electricals industry as well as deepening the existing relationship between Currys and Studio, with the potential for further collaboration between the two”.

N Brown

At the start of the year Frasers significantly increased its stake in N Brown to 17.88% to become its second-largest shareholder behind Lord David Alliance, who acquired the group in 1968.

Hugo Boss

After increasing its investment in the luxury fashion brand late last year, in January Frasers revealed that its financial exposure to Hugo Brand had fallen to £580m.

Fraser now holds 3.9% of Hugo Boss shares but has a put option over an additional 25%, below the 4.3% stake and 30.3% in put options it held in November.

Mulberry

Back in November Frasers raised its stake on the luxury retailer to almost 37% although a month later the group said it would not be making a formal offer for Mulberry, wiping £15m off its value.

What does Next own?

FatFace

Acquired: October 2023

FatFace has become the latest high street chain to be snapped up by Next after it swooped in with a £115.2m takeover deal in September.

The retail giant will hold a 97% stake, while current management will maintain a 3% hold in the business.

It said the retailer will retain its management autonomy and creative independence, but that its plans to migrate its online operations onto its Total Platform within the next twelve months.

Reiss

Acquired: 72% in September 2023

Next took a 25% stake in Reiss in March 2021, which it upped to 51% last summer and then again last month to 72%.

It paid £33m for the 25% stake and gave Reiss a £10m loan. As part of the deal, Next began operating Reiss’ website and online operations contracted to Next through its total platform.

Reiss chief executive Christos Angelides, who was previously group product director at Next, has continued to lead the business. The brand still owns creative independence with its own independent board of directors, however, Next boss Lord Wolfson became its chairman in 2021

Following Reiss’ integration onto Total Platform, its delivery and returns offer has been brought into line with Next’s market-leading proposition, which includes faster delivery, later cut-offs and more click-and-collect points.

The retail giant has helped to boost Reiss’ performance. It bought out private equity Warburg Pincus at the start of September for £128m squashing reports it was looking offload the retailer in a £500m sale.

Cath Kidston

Acquired: March 2023

Next acquired Cath Kidston’s brand name, domain names and intellectual property after the business fell into administration in March.

The retail giant paid £8.5m for the intellectual property in a pre-pack deal.

The group relaunched the brand on its website in June earlier this year, selling its full range of vintage-inspired clothing, gifts and home accessories.

Joules

Acquired: December 2022

Next bought Joules in a £34m deal after the fashion retailer collapsed into administration last November.

Partnering with founder Tom Joule, the retail giant now has a 74% stake in the British retailer with the remaining 26% still owned by Joule.

Next plans to relaunch Joules in October.

However, the retail giant launched consultations with Joules staff in April as it said a number of tasks could now be absorbed into the retail giant’s teams or are no longer be needed.

Made.com

Acquired: November 2022

Despite being one of the pandemic winners, Made.com fell into administration after struggling to bounce back from the slowdown in demand for homeware amid the cost-of-living crisis.

The online furniture retailer was quickly snapped up by Next in November in a £3.4m deal, which includes the etailer’s brand, domain names and intellectual property.

Next, which has a thriving furniture and homewares business, has yet to reveal its grand plans for Made.com

Jojo Maman Bébé

Acquired: 44% stake in April 2022

Specialist baby goods retailer JoJo Maman Bebe was bought out by Next and a group of investors back in April.

Next, which owns 44% of JoJo after it made a £16.3m cash investment, has kept the brand distinct from the rest of its fashion and homewares business.

The brand’s boutique stores have remained open while Next operates its online business via its online platform.

Victoria’s Secret UK

Acquired: 51% stake in September 2020

After lingerie giant Victoria’s Secret fell into administration in the UK in June 2020, Next snapped up 51% of the UK division in a joint venture with the brand’s US parent company L Brands.

Next operates Victoria’s Secret stores, in-store concessions and the brand’s website.

In its year to January 2022, the retailer made a £3.4m profit from Victoria’s Secret UK, which was lower than expectations due to stock shortages.

It expected to make around £4m profit from the brand in its last financial year.

Gap UK

Acquired: 51% stake in September 2021

In the same month it signed with Victoria’s Secret, the high street giant made a similar deal with Gap, two months after it decided to close down its UK stores in 2021.

Next now owns a 51% stake in Gap as a franchise partner and manages the online business in the UK and Ireland which has fully migrated into the retailer’s Total Platform.

The retailer has also opened six Gap branded shop-in-shops including at its Oxford Street flagship, Lakeside, Birmingham and Manchester earlier this year.

It is also brinigng Gap-owned Banana Republic back to the UK via Next.

Lipsy

Acquired: 2008

Young fashion brand Lipsy was acquired by Next back in 2008 for £17.4m.

Since then, the retail giant has slowly transitioned the brand into its fold.

In 2018, Lipsy’s website closed down redirecting its traffic to Next where the majority of sales were driven through.

The high street giant has opened Lipsy concessions in multiple stores. The brand has been particularly successful online. Three years ago, Lipsy’s made just £6.8m via ecommerce, in its last financial year it made £27.5m.

Click here to sign up to Retail Gazette‘s free daily email newsletter