2022 was a year plagued by sky-high inflation and dampened consumer demand, as the ‘cost-of-living ‘crisis became the buzzword of the year.

It looks like retail sales will continue to be challenging in the first half of 2023.

The BRC predicts retail sales will edge up between 1% and 2.3% in the first six months of year.

However, the trade body forecasts a brighter second half, with retail sales expected to grow 3.6% to 4.7%.

Although the headline annual figure of 2.3% and 3.5% growth looks positive, this is driven by price inflation with sales volumes expected to fall.

BRC director of insight Kris Hamer says: “Ongoing inflation will make sales appear to be rising, but we expect falling volumes as consumers continue to manage their spending.”

Meanwhile, economics research consultancy Retail Economics is expecting value growth of 4% in 2023, just a smidge higher than in 2022, although it is also forecasting price inflation of 7.5% across retail, so volumes are expected to decline 3.5%.

It also expects the online penetration rate to be 26.5% in 2023, broadly unchanged from last year as ecommerce continues to rebalance in the aftermath of the pandemic, which brought a surge of people online shopping.

Which sectors will be in growth?

Grocery +6.0%

Retail Economics predicts that grocery will be the strongest performing category with sales up 6% on last year.

This is unsurprising as shoppers with squeezed budgets prioritise essential items.

Tesco boss Ken Murphy says that the consumer has remained resilient post-Christmas and spent as normal in January.

He says that customers are expressing a “sentiment of cautious optimism”.

“Customers are weathering the storm in a full employment market and the recession might be shallower than predicted,” he says.

Retail Economics chief executive Richard Lim highlights that with all sales forecasts for the year, and grocery is no exception, the impact of inflation needs to be taken into account.

“We’re still expecting inflation to be to be significant throughout 2023,” Lim explains, adding it’s “certainly going to boost top-line growth for the grocery sector”.

“So while it might look healthy, I think the important consideration is the impact on profitability.”

Grocers are grappling with rising food production costs and energy bills, which Lim says are particularly onerous in this sector as it is very energy-intensive with lots of refrigeration needed.

Iceland saw its energy bill jump from £70 million to about £155 million last year and is scaling back the amount of chilled food it sells in an effort to reduce its energy bills.

It’s not just grocers but shoppers that are facing rising bills, which means, even as inflation eases in the second half, spending priorities will remain essential grocery, children and health products, according to PwC consumer markets leader Lisa Hooker.

She believes that value for money will remain critical with switching and trading down set to remain prevalent.

Gartner director analyst Matt Moorut concurs and says retailers will need to further reassess their value proposition to convince consumers to stick with them.

Last week, Lidl revealed it has gained nearly £11 million in switching gains from M&S, Waitrose and Sainsbury’s during January, an increase of over £10 million year on year.

Grocery retailers have started off the new year with price campaigns to stem the tide of shoppers shifting to the discounters with Tesco, Morrisons, Sainsbury’s and Waitrose firing the gun on a new tranche of price cuts.

Clothing +4%

Clothing growth will be slower, with Retail Economics predicting just 4% growth over the year. Although it must be flagged that the sector did have a boost last year with sales up 19.1% after the lows of the lockdown.

There is definitely a note of caution in the air across fashion’s leaders. Next boss Lord Wolfson has forecast a sales decline of 1.5% for his year to January 2024.

He acknowledges that “some might think this forecast is overly cautious”, but believes inflation in essential goods, particularly energy, rising mortgage costs, and price rises in its own products will quell sales.

However, he does expect the UK employment to remain strong so is not anticipating “a collapse in demand”.

FatFace CEO Will Crumbie tells Retail Gazette that consumer spending is going to become even harder to predict this year. He expects it to result in retailers tracking spending habits and sentiment even more closely.

“Only time will tell how much consumer decision-making and spending levels will be impacted over the next 12 months.

“Despite this, our job remains simple; to design high-quality clothing for all ages that our customers love and want to buy. If we do that, we will be in the best place to thrive in any market.”

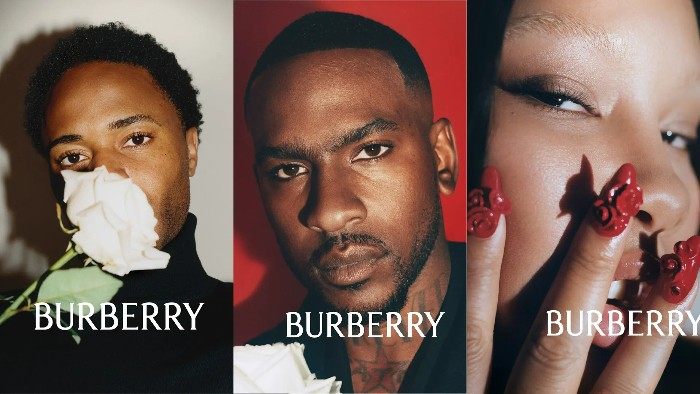

There is one area of fashion that McKinsey expects to thrive in 2023 – luxury. The consultant’s State of Fashion report forecasts that global luxury fashion sales will grow up to 10% in 2023 as wealthy shoppers contine to travel and spend.

However, it does expect growth to be driven by China and the US as it points out that Europe is facing currency challenges and an energy crisis. It therefore lowers its projected growth to 3% to 8% across the continent.

Furniture and flooring +0.2%

2022 was a dismal year for furniture retailers with the likes of Made.com, Snug and Eve Sleep all collapsing into administration as shoppers cut back on big-ticket items as their budgets became more squeezed.

Lim says 2023 will continue to be challenging for the sector, which has seen “quite a significant amount of demand pulled forward from the impacts of the pandemic”.

He adds that during Covid, when lots of people were on furlough, they spent more time at home and as a result invested in their spaces, pulling forward demand.

“And that has been to the detriment of sales we’ve seen over the last few months and what we can expect to see in 2023.”

He predicts that furniture sales will inch up 0.2% over the year.

Homewares +0.9%

It’s a similar story in homewares, where shoppers have already made their investments. Retail Economics predicts that sector sales will edge up 0.9% over the year.

Dunelm is focusing on delivering value more than ever in this environment and with sales up 5% in its latest quarter to December 31, it is enticing customers to spend.

Dunelm chief executive Nick Wilkinson says: “We are all learning to live in a new, complex and rapidly evolving economic reality.

“Recognising this, our focus has been on ensuring that we continue to offer outstanding value to our savvy customers through a proposition which is committed to quality, at the right price, across an expanding range of relevant products. We believe that this is why we have continued to grow our sales, customer numbers and market share.”

“In this environment, agility, creativity and innovation are more important than ever and we have endeavoured to make every pound count, both for ourselves and for our customers, helping to mitigate the impact of inflation.”

Electricals

Electricals will be the worse hit sector over the course of 2023, according to Lim.

The sector, once again, had a bumper pandemic and many purchases were brought forward.

Meanwhile, the big players in the market, Currys and AO.com, are focusing on profitability rather than driving sales through promotions.

Currys has also said it will pass more of its rising costs onto consumers.

Boss Alex Baldock says: “We’re leading more boldly on price rises, and we’re charging for services more now as well.”

The retailer has recently introduced delivery charges on major appliances and TVs.

He adds: “We’re doing fewer promotions – the promotional intensity significantly declined – and we’re especially doing none of the less profitable ones.”

Health & Beauty

The health and beauty sector is one that generally remains resilient in tough economic climes as shoppers continue to splash out on little treats to make themselves feel good.

PwC’s Hooker puts health as one of the areas shoppers will prioritise spend throughout the year.

The signs from Christmas show this to be true as all the big players in the sector including Boots, Superdrug and Lush, posted strong results.

Boots said it achieved a record-breaking Black Friday with boots.com recording its biggest-ever day of sales and added that strong high street footfall helped sales increase in its latest quarter.

Since then it has also revealed its “biggest ever savings” to help support cash-strapped shoppers during the cost-of-living crisis, adding 60 new lines to its ‘Boots Everyday’ value range, while also renewing its Price Lock initiative by freezing prices on essentials.

Boots UK & ROI managing director Sebastian James says its strong value was one of the factors that was helping it grow sales and market share.

Lush also had its highest-ever trading month in December with sales of £40.5m, exceeding its forecasts and beating pre-pandemic sales.

Online – 0.3%

The last year has been turbulent in ecommerce, following from the surge in online shopping during the pandemic.

According to trade body IMRG, online sales have declined every month since April 2021, bar a slight rise in November 2022. However, sales still remain 17% higher than 2019’s pre-pandemic levels.

IMRG believes that online sales will decline 0.3% in 2023.

There was no indication that things were improving for the big ecommerce players over Christmas with Boohoo sales down 11%, and Asos’ falling 8% as it blamed “weak consumer sentiment”.

Last month, Primark’s finance chief John Bason claimed that the UK’s online clothing market may have hit a ceiling.

“You’ve got to start to question the maturity now of online in the United Kingdom,” he says.

Click here to sign up to Retail Gazette‘s free daily email newsletter