// One in 10 shoppers claim to have started stockpiling food to prepare for a no deal Brexit

// Co-op gained 244,000 more shoppers with visitors spending £13m more on fruit, veg & salads

// 41% of Ocado shoppers also visited Waitrose during the past 12 weeks

// Overall grocery sales rose 1.9% year-on-year

One in 10 shoppers have reportedly began stockpiling food to prepare for a potential no-deal Brexit, according to a survey.

READ MORE:

- February retail sales dented by Brexit uncertainty (BRC-KPMG)

- UK consumer confidence rises in February despite Brexit uncertainty

- February shop price inflation hits 6-year high (BRC-Nielsen)

- Shoppers defy high street gloom with optimistic January footfall (Ipsos)

- Retail sales makes a strong comeback in January (ONS)

- January inflation falls below targets (ONS)

- Retail vacancy rate climbs to 9.9% as January footfall declines (BRC-Springboard)

- Online sales off to a sluggish start for the year

As uncertainty intensifies and some customers start their preparations for what could be a disorderly exit from the EU on March 29, Kantar Worldpanel’s latest grocery market share figures show year-on-year grocery sales growth of 1.9 per cent during the 12 weeks to February 24.

For the four-week period ending February 24, sales rose 1.2 per cent.

Kantar Worldpanel said the stable growth it meant the stockpiling claims from shoppers had not yet been reflected in grocery sales.

“Despite one in 10 shoppers saying they have started stockpiling groceries and a further 26 per cent reporting that they are considering doing so, this has not been borne out in sales just yet,” Kantar Worldpanel head of retail insight Fraser McKevitt said.

Kantar Worldpanel surveyed 7008 adults online between February 1-4 for its findings on shoppers stockpiling groceries.

Meanwhile, Sainsbury’s was the worst performer of the Big 4 grocers over the 12 weeks to February 24.

The retailer – which recently hit a snag in its proposed £12 billion merger with Asda – suffered a sales drop of one per cent.

This led to a reduction in Sainsbury’s market share by 0.5 percentage points to 15.7 per cent.

This compared with gains of 1.3 per cent, one per cent and 0.8 per cent at Tesco, Asda and Morrisons respectively.

Last month, the CMA said in a provisional ruling that it could block the proposed Sainsbury’s-Asda deal unless the duo sold off stores or even one of the brands.

The competitions watchdog is set to deliver its final ruling in April.

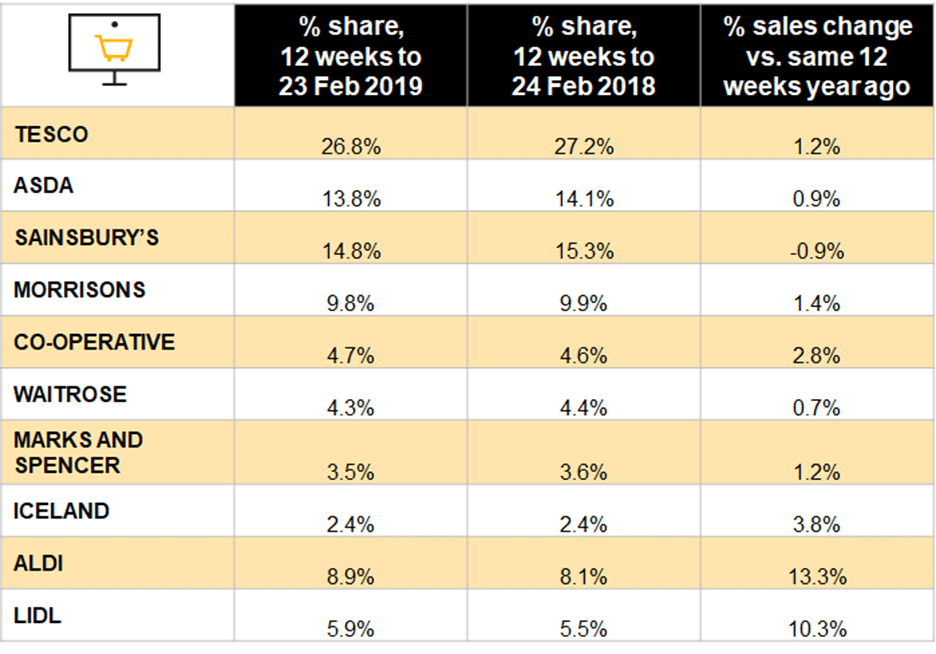

Meanwhile, Kantar Worldpanel’s data showed that once again, all of the Big 4 retailers lost market share in the 12-week period to German discounters Aldi and Lidl.

Aldi’s sales were up 10 per cent, while Lidl’s rose 5.4 per cent, taking their combined market share to 12.8 per cent.

On the other hand, separate data from Nielsen reported that growth in shoppers’ spending slowed to 2.5 per cent in February from 3.3 per cent last month.

Analysts said consumers were spending less per visit as Brexit caused increased caution.

Nielsen figures for the last 12-week period show Tesco leading with 26.8 per cent market share, followed by Sainsbury’s at 14.8 per cent, Asda at 13.8 per cent and Morrisons at 9.8 per cent.

Click here to sign up to Retail Gazette‘s free daily email newsletter