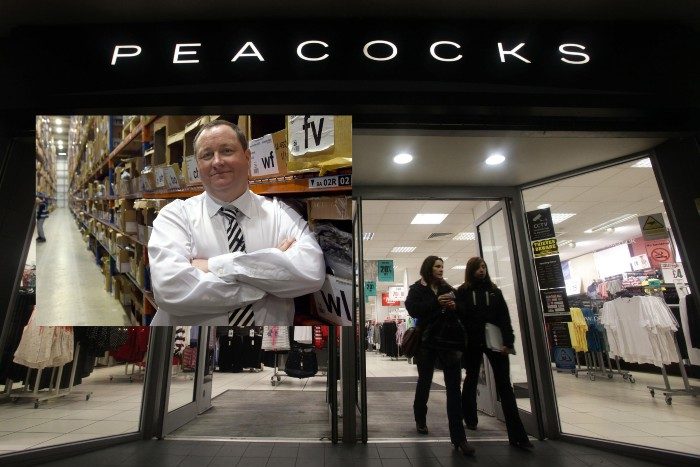

// Mike Ashley’s Frasers Group “frustrated” with administrators at FRP “to provide key financial information” on Peacocks

// Frasers Group had participated in discussions with FRP and representatives of EWM Group on a possible takeover of Peacocks

// On March 27 Frasers Group wrote a letter to FRP claiming it had insufficient access to Peacocks’ financial information

Mike Ashley’s Frasers Group has expressed frustration after it was reportedly not provided key financial information on Peacocks after it submitted an expression of interest in the beleaguered retailer.

Frasers Group said it was “frustrated” with the unwillingness of administrators at FRP Advisory “to engage substantively” or “to provide key financial information” so it could make an informed offer for Peacocks, which had been under administration.

Yesterday it was revealed that an international investment consortium, backed by Edinburgh Woollen Mill Group’s (EWM) chief operating officer Steve Simpson, bought Peacocks out of administration.

READ MORE:

- Peacocks rescued from administration

- Philip Day’s Peacocks owes creditors £70m

- Edinburgh Woollen Mill, Ponden Home & Bonmarche saved in deal protecting 1984 jobs

The move will see Simpson saving 2000 jobs and 200 Peacocks stores, which he hopes to reopen once lockdown restrictions on non-essential retailers ease.

Peacocks was part of the Philip Day-owned EWM Group fashion retail empire which collapsed in November last year.

Frasers Group said in a statement that its advisers participated in discussions with Peacocks’ administrators at FRP Advisory and representatives of EWM Group.

However, on March 27 Frasers Group wrote a letter to FRP Advisory claiming it had insufficient access to Peacocks’ financial information.

“At no point in the discussions were the secured creditor or the joint administrators prepared to allow Frasers Group the same access to key stakeholders and information as the purported purchaser was allowed,” Frasers Group said in its statement.

Ashley’s firm added that it became “repeatedly frustrated in the administrator’s unwillingness to engage substantively or to provide key financial information”.

“The actions of the secured creditor and the joint administrators made it virtually impossible for Frasers Group or any other third-party to provide a credible alternative to the purported sale to the connected party,” Frasers Group stated.

FRP Advisory has not yet responded to Frasers Group’s claims.

During the pandemic and leading up to EWM’s collapse, Peacocks shut down 200 stores – around half its estate – and made 2000 redundancies as it struggled to manage under the various restrictions.

Day was the biggest creditor of Peacocks and is owed money by the business he once owned.

FRP Advisory negotiated a deal with him by signing a deferred loan agreement between a consortium of investors and the businessman which will eventually see him get his money out of the retailer.

The consortium of international backers, led by Simpson, are primarily based in Dubai, where Day also lives.

A similar deal was set in place with EWM’s Bonmarche, Ponden Home and the flagship Edinburgh Woollen Mill fascias, while Jaeger was sold to Marks & Spencer, where it will become an online-only business.

The deal essentially sees all the former EWM brands – excluding Jaeger – reform under the old management led by Simpson.

However, Day will not be in control of the business – ending several decades of involvement in the UK high street.

Ashley previously complained that Frasers Group was frozen out of the auction for three of the EWM Group fascias and also accused insolvency consultants of withholding key financial information.

A spokesman for Day said that the process had been run fairly, with all the bidders having access to the same information and opportunity to bid.

Click here to sign up to Retail Gazette’s free daily email newsletter