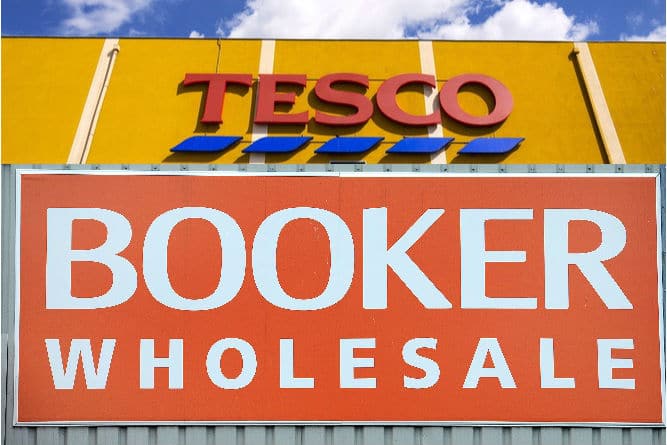

Almost 84 per cent of Booker shareholders have approved the proposed £3.4 billion takeover by Tesco, giving the deal the final greenlight it needs for the merger to proceed.

Provisional figures show that 83.4 per cent of Booker shareholders approved the proposal during a meeting today, more than the 75 per cent needed by the wholesale and convenience retail business for the deal to go ahead.

Earlier in the morning, 85.22 per cent of Tesco shareholders voted in favour of the takeover to proceed, with 14.28 per cent against it.

READ MORE:

- Tesco shareholders green light takeover but Booker vote yet to come

- Second major advisory group urges rejection of Tesco-Booker merger

- Booker CEO Charles Wilson appointed CEO of Tesco’s UK & Ireland arm

- Wholesalers weigh up appeal on Tesco-Booker merger

- CMA gives final blessing for £3.7bn Tesco-Booker merger

Compared to Booker, Tesco only needed 50 per cent of support from shareholders for the deal to proceed.

The shareholders’ approval means the takeover will be completed and operational from March 5.

The Competitions and Markets Authority (CMA) already gave the takeover its full blessing back in December.

Booker chief executive Charles Wilson has also already been appointed chief executive of Tesco’s UK and Ireland division, taking over from Matt Davies during a handover period in April.

While the Tesco vote results was expected, concerns over the benefits of the deal for Booker had been growing in the last few weeks.

Numerous shareholder advisory firms, such as Glass Lewis and the Institutional Shareholder Services, urged Booker investors to vote against the takeover, with the former stating there was “little cause for Booker investors to support what appears to be a less than compelling control transaction”.

Various wholesale firms have also criticised both the deal and CMA’s approval of it.

Tesco’s takeover of Booker was first announced in May last year, although reports have emerged that plans to link the two companies were underway behind the scenes as early as 10 years ago.

Click here to sign up to Retail Gazette‘s free daily email newsletter